Open-Weight Models Just Landed in Sydney: What This Means for Australian AI Sovereignty

- Stephen Jones

- February 16, 2026

Table of Contents

If you’ve been building AI workloads in Australia, you’ve felt the frustration. The models you want to use are sitting in US regions. Your compliance team is asking where inference data is being processed. And every API call is adding 180-200ms of network latency before the model even starts thinking. Run a five-step agentic workflow and you’re adding a full second of pure network overhead before any model computation happens.

That friction just got a lot smaller.

The Announcement

On 12 February 2026, AWS announced that Amazon Bedrock now supports the latest open-weight models in the Asia Pacific (Sydney) region. Models from DeepSeek, Google, MiniMax, Mistral, Moonshot AI, Nvidia, and OpenAI are now available through a new service called Project Mantle, a distributed inference engine purpose-built for large-scale model serving.

The models are accessible via a bedrock-mantle endpoint that’s OpenAI API-compatible, with serverless inference, automated capacity management, and higher default customer quotas.

This isn’t just another regional expansion. This is the infrastructure layer catching up with what Australian organisations actually need.

Why This Matters More Than You Think

Let’s be clear about the context here.

Australia’s National AI Plan, released in December 2025, explicitly calls for sovereign compute capability. The government is developing national data centre principles. Large AI users are being encouraged to deploy compute locally. Every government agency is appointing a Chief AI Officer. And the APS AI Plan targets all public servants being AI-enabled by mid-2026.

The government isn’t just talking about it either. They’ve built GovAI Chat, a sovereign generative AI platform running within Australian Government infrastructure. All data stays within Australia, under government control, with a vendor-agnostic platform that lets agencies select models. That includes an onshore instance of OpenAI’s GPT models.

Meanwhile, the private sector investment is staggering. Australia attracted $10 billion in data-centre investment in 2024, ranking second globally. More than $100 billion in new data-centre projects have been announced. AWS alone committed AU$20 billion between 2025 and 2029, the largest global tech investment in Australia’s history. OpenAI and NextDC announced a $7 billion hyperscale AI data centre in Western Sydney. Sharon AI is deploying a 1,016-GPU supercluster in NextDC’s Melbourne facility.

The infrastructure is being built. What was missing was the model diversity.

The Open-Weight Difference

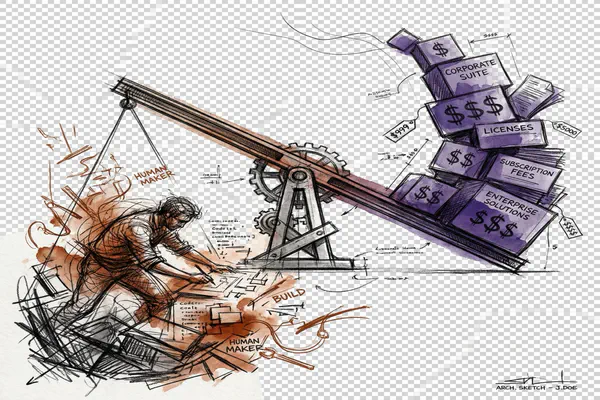

Here’s the uncomfortable part about proprietary-only model access: you’re locked in.

If your only option for on-shore inference is a single vendor’s proprietary model, you’ve traded one sovereignty problem for another. You’ve moved the data on-shore, but your entire AI capability depends on a single provider’s roadmap, pricing, and availability decisions.

Open-weight models change the equation:

- Vendor independence. You can switch models without rewriting your application. DeepSeek for reasoning, Mistral for code generation, a smaller model for classification. Mix and match based on the task.

- Transparency. You can inspect the weights, understand the model’s behaviour, and audit how it handles your data. For government and regulated industries, this isn’t optional.

- Customisation. Fine-tune on your domain data without sending it to a third party. Healthcare, defence, financial services: all sectors where this matters.

- Cost optimisation. Run smaller, task-specific models where you don’t need frontier capability. Not every inference call needs a 400B parameter model.

The US military is already using Meta’s Llama models through dedicated deployments. Defence startup Legion Intelligence built SOFChat with Llama, enabling special operations forces to generate intelligence reports 18 times faster. That’s the kind of flexibility open-weight models unlock, and Australian organisations deserve the same access on home soil.

What’s Actually Available

The Sydney deployment includes models from seven providers through Project Mantle. Recent additions to Bedrock’s open-weight roster include:

- DeepSeek V3.2 for frontier reasoning

- MiniMax M2.1 for general-purpose tasks

- GLM 4.7 and GLM 4.7 Flash from Zhipu AI

- Kimi K2.5 from Moonshot AI

- Qwen3 Coder Next for code generation

- Mistral Large 3, Ministral 3 (3B, 8B, and 14B variants)

All running on AWS infrastructure in Sydney. All accessible through a single API that’s compatible with existing OpenAI client libraries. That last point matters: if your team has already built tooling against the OpenAI API format, migration is straightforward.

AWS also supports cross-region inference between Sydney and Melbourne through their GEO CRIS capability. Your requests route within Australia’s geographic boundaries for the entire inference lifecycle. The latency overhead for cross-region routing is double-digit milliseconds, not the 180-200ms you’d add routing to US East.

The Competitive Landscape

Let’s compare where the three major clouds stand for Australian AI workloads right now.

AWS now offers Bedrock with open-weight models in Sydney, Claude Sonnet 4.5 and Haiku 4.5 via cross-region inference within Australia, Amazon Nova models, and the new Project Mantle infrastructure.

Microsoft Azure has GPT-4o available in Australia East. But GPT-5 and o3 Pro are not available in the Australian region. If you need the latest frontier models on-shore, Azure has gaps.

Google Cloud runs Vertex AI in australia-southeast1 with GPU support and Gemini model access, though the specific model roster for the Australian region is less clearly documented.

AWS is making an aggressive play here. The combination of open-weight diversity, cross-region sovereignty guarantees, and a AU$20 billion infrastructure commitment is hard to match.

The Global Sovereign AI Race

Australia isn’t doing this in isolation. The global sovereign cloud market is projected to grow from $154 billion in 2025 to $823 billion by 2032. The trend toward sovereign AI infrastructure is accelerating fast.

France has Mistral AI building an end-to-end cloud platform with 18,000 NVIDIA Blackwell GPUs. Germany has Deutsche Telekom operating the world’s first industrial AI cloud with 10,000 Blackwell GPUs, plus AWS committed EUR7.8 billion to build a European Sovereign Cloud with its first region in Germany. Italy launched the NeXXt AI factory through Fastweb. Singapore committed S$1 billion over five years for AI compute and launched its first sovereign AI factory through Singtel. The UK established “AI Growth Zones” and a three-tiered compute strategy covering sovereign, domestic, and international infrastructure.

Across Europe alone, over 3,000 exaflops of NVIDIA Blackwell compute is being deployed for sovereign AI. Microsoft committed to processing Microsoft 365 Copilot interactions in-country for 15 nations by end of 2026.

Australia’s National AI Plan positions the country in this same wave. But the approach is different. Rather than building national GPU clusters from scratch, Australia is leveraging hyperscaler investment while setting policy guardrails around data residency and sovereign compute principles. The Hosting Certification Framework, which governs where sensitive government data can live, was actually paused in November 2025 pending reforms, a signal that the rules are being rewritten for the AI era.

That’s a pragmatic strategy. Whether it’s sufficient is the open question.

The DeepSeek Question

Let’s talk about the elephant in the room. DeepSeek is on the model list.

In February 2025, Australia became the first country to ban DeepSeek from all government devices. Home Affairs Minister Tony Burke cited “unacceptable risk” to national security. Multiple states and territories followed. The concerns were real: DeepSeek’s hosted API sends data to Chinese servers, the model has documented safety vulnerabilities (Cisco researchers found a 100% attack success rate in safety testing), and China’s internet regulations shape its behaviour on politically sensitive topics.

So why is this a good thing?

Because open weights change the risk calculus entirely. When you run DeepSeek R1 on Amazon Bedrock in Sydney, no data goes to China. The model weights are auditable. AWS Bedrock Guardrails can be layered on top to address the safety gaps. You get frontier reasoning capability at roughly 27x lower cost than OpenAI o1, running on Australian infrastructure, with enterprise security controls.

That’s the whole point of open-weight models on sovereign infrastructure. You separate the model’s capability from its origin’s risk profile.

Honest Assessment

A few things this announcement doesn’t solve.

Not all models are available locally. The announcement covers open-weight models through Project Mantle. Proprietary models like GPT-5 or some frontier capabilities may still require routing to US regions depending on the specific model and access method.

Fine-tuning infrastructure isn’t guaranteed. Running inference locally is one thing. Training and fine-tuning on Australian infrastructure is a different ask, and the announcement focuses on inference.

Compliance is your responsibility. Having models available in Sydney doesn’t automatically make your workload compliant. Australia doesn’t have a single “data must stay here” law, but the combination of APP 8 accountability under the Privacy Act, ASD guidance on locality and control, Hosting Certification Framework requirements, and sector-specific regulations (particularly health, where data must never leave Australia) creates a de facto data sovereignty regime. You still need to address these in your architecture.

Open-weight doesn’t mean open-source. Some of these models come with licensing restrictions on commercial use, modification, and redistribution. Read the licences carefully, especially for government and defence use cases.

The Bigger Picture

What we’re seeing is the infrastructure layer of AI finally decentralising. For years, if you wanted frontier AI capability, your data had to travel to the US. That’s changing, and the shift has real implications.

For Australian organisations building AI workloads, the calculus is simpler now. You can access a diverse set of capable models, running on Australian infrastructure, through a standard API, with sovereignty guarantees built into the routing layer. That removes one of the biggest blockers I’ve heard from infrastructure teams across government and enterprise.

There’s a flywheel forming here. Policy requirements drive infrastructure investment. Infrastructure investment enables sovereign AI deployment. Sovereign AI deployment validates the policy approach. And the policy approach attracts further investment. The $100 billion-plus in announced data-centre projects suggests that flywheel is already spinning.

The combination of Australia’s National AI Plan pushing for sovereign compute, $100 billion in committed infrastructure, open-weight models arriving in Sydney, and domestic GPU clusters coming online feels like an inflection point. Not because any single piece is revolutionary, but because they’re all landing at the same time.

If you’re running AI workloads in Australia, or planning to, this is the moment to revisit your architecture assumptions. The models are here. The infrastructure is funded. The policy direction is set.

The question isn’t whether Australian AI sovereignty is achievable. It’s whether your organisation is ready to take advantage of it.

I hope someone else finds this useful.

Cheers.